As first-time homebuyers try to muscle their way into today’s highly competitive housing market, many are finding themselves priced out of buying — but renting offers little relief. Nationally, the median mortgage payment for mortgage applications submitted in February 2022 was $1,653, up from $1,316 a year earlier, according to the Mortgage Bankers Association (MBA). This $337 or 26% increase is thanks to both the…

Mental Health Awareness

04 AugMental health <> Realizing Home Ownership Factors that impact the process Low income Credit score Lack of education Fear Threat of being discriminated against Body becomes tense, tenses up and then when you realize how daunting the task may be, you shut down the idea and move about your day. Why Black Homeownership Matters Homeownership has been the most effective…

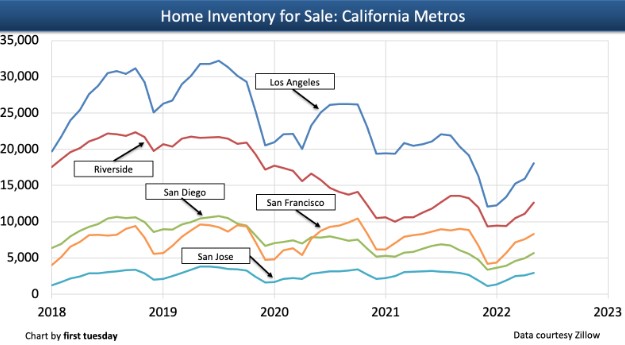

Homebuyer demand continues to outpace inventory for sale

05 JulMultiple listing service (MLS) inventory has risen from the historic low reached at the end of 2021. After two years of steep decline, for-sale inventory in California’s largest metros averaged just 1% below a year earlier as of May 2022, according to data from Zillow. The winter months typically see the lowest inventory of homes for sale, peaking around mid-year. The inventory…

3 of the top 9 reasons that the real estate bubble is bursting

02 JunIf you own real estate or are thinking of buying real estate then you better pay attention, because this could be the most important message you receive this year regarding real estate and your financial future. The last five years have seen explosive growth in the real estate market and as a result, many people believe that real estate is…

10 Ways to Buy a Home With Little or No Money Down

10 MayThere are many ways to buy a home, even if you have little or no money to put down. Here are a few of the basics: Sweat Equity – Sweat Equity is a way to get a home by trading work for equity in the house. This could be used for a down payment or for purchase later. This is…

7 Simple Steps To Real Estate Investing

09 AprWhether you are BRAND NEW to real estate investing or an expert in the game, it’s critical that you understand these 7 Simple Steps to real estate investing. First things first… • Real Estate is NOT a get rich quick scheme. However, if you learn the foundations and put them into practice, you will make more than enough money to…

What Should Be Considered Before Buying Home?

07 MarWhether it’s your first time buying a home or not, you should familiarize yourself with the whole mortgage process. Numerous mortgage lenders will assist you in the process of acquiring a pre-qualified and pre-approved home buying application. Of course, your mortgage qualifications will be required by your agent to strengthen your deal in finding and buying a home. Whether it’s…

Common Mistakes of First Time Home Buyers

08 FebBuying your first home is exciting. No more rental payments to a landlord making money for someone else. Instead, you are purchasing your own home and investing in yourself. Money paid to your home mortgage is really investing in your future. It is no wonder that first time home buyers are so excited, sometimes so excited that they make mistakes….

5 Ground Rules for Home Buying Success

09 JanThere are five basic ground rules that you must know when it comes to buying a home and shopping smart, and they are …. There are few purchases in life that carry the financial and psychological weight of buying a home. Whether you are buying your first home, moving up to your dream home, or downsizing your home and your…

First Time Buyers – Getting On The Property Ladder

03 DecGetting a foothold on the property ladder is not easy – particularly these days with property prices above the amount most people’s salaries can cover. Reports from the property market show that the age of first time buyers has increased in recent years as younger people struggle to get a mortgage. Some first time buyers struggle to cover all the…